Chiralkine counting can be used to control the exchange of goods and services in a way that treats participants symmetrically. It provides a solution to the double co-incidence of wants problem inherent in barter that works on a new principle, not money and debt.

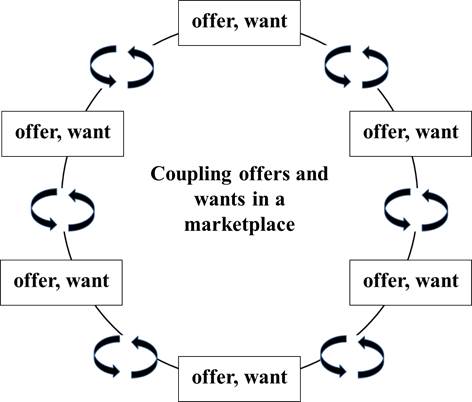

The paired numbers can be used to couple together offers and wants posted in a marketplace, ensuring that the interests of participants are tracked until their offers and wants have been cleared.

Offers and wants posted in the marketplace are cleared using a process under the control of chiralkine counting.

In principle, with very fast computing mediated through an information transmission network, such as the internet, this could be implemented by initially forming chains then rings. However, and this is a key innovation, the same effect as forming a ring can be achieved by allowing the chain ends (in b states) to switch into c states when coupled with the inversion of a complementary pair of a states (an inversion of ownership, as from mine, not yours to not mine, yours, in one step). This ensures that any pair of participants in an exchange system exchange with everyone else in accordance with the double coincidence of wants. The medium of exchange is described as left and right handed money in the original descriptions of this mechanism and the coupling mechanism is described as a chiralkine contract: an agreement between the members of the pair of participants. This system could enable much faster clearing of offers and wants than forming long chains that eventually close up on themselves, when what is wanted at one end is what is offered at the other.

There are no imaginary stores of value (money and debt) created and redeemed in this process. Each “want” is paid for with an “offer” that is real. The entire process could be performed under the control of smart locks that would lock and unlock objects being exchanged under the control of the chiralkine counting.

What is needed now is to code the system for implementation using a decentralised ledger, such as block chain. Such a system would offer the potential to completely dispense with the need to use any imaginary store of value (money, cryptocurrency, etc) to enable exchange of goods and services. It could work globally, such that trade could be completely free. Moreover, it would likely reset relative values of subjects being traded, for example services and assets such as houses, which have been grossly distorted by quantitative easing, making housing much more affordable and easier to buy and sell. All this would need to be carefully tested before any implementation!